VAT solutions that provide peace of mind.

Ever changing regulations and the growing demands of HMRC means VAT compliance can be a difficult administrative process. However we can help simplify the process for your business.

Lets talk

"We can provide an efficient, cost-effective VAT service for your business."

VAT Services

At Everest & Co we can help to ensure that you comply with the regulations and prevent penalties arising from unpaid taxes. We also offer expert advice to reduce the VAT liability by ensuring all allowable expenses are claimed for. To help you manage this complex area, we provide an efficient, cost-effective VAT service, which includes:

Assistance with VAT Registration

We highlight the key VAT areas you need to consider when running your business. If you are starting or have recently started a business, we, at Everest & Co – Accountants, can help you comply with the VAT regulations.

You must register for VAT if your VAT taxable turnover goes over £85,000 (the ‘threshold’), or you know that it will. Your VAT taxable turnover is the total of everything sold that is not VAT exempt. You can also register voluntarily. For more information go to www.gov.uk/vat-registration/when-to-register.

You must register for VAT if:

- You expect your VAT taxable turnover to be more than £85,000 in the next 30-day period

- Your business had a VAT taxable turnover of more than £85,000 over the last 12 months

67000 Application of VAT

Value added tax (VAT) was introduced in the UK on 1 April 1973 as a condition of the UK joining what was then the European Economic Community (EEC), now the European Community (EC) or European Union (EU). The UK left the EU on 31 January 2020 and entered a transition period during which a trade agreement with the EU was negotiated. The transition period ended at 11 pm on 31 December 2020, at which point the UK left the EU ‘fully’.

VAT has been retained in the UK after 31 December, and many aspects of the tax, particularly those relevant to domestic transactions were unaffected by the end of the transition period. See ¶67005 for details on the application of EU law and use of EU law in this commentary in relation to supplies made after this date.

However, because Northern Ireland remains a member of the EU single market and customs union in when trading in goods (unlike Great Britain which is outside the single market), a customs border has been created between Northern Ireland and Great Britain. As a result there were significant changes to the VAT implications of goods moving from Great Britain to Northern Ireland as a result of the UK’s exit from the EU.

VAT is charged on:

- taxable supplies of goods and services made in the UK, where these are made in the course of business (see ¶67830ff.);

- imports of goods into the UK (¶72400);

- until 31 December 2020 the acquisition of goods in the UK from elsewhere in the EU (¶72800);

- from 1 January 2021 the acquisition of goods in Northern Ireland from elsewhere in the EU (¶72800);

- from 1 January 2021 the movement of goods from Great Britain to Northern Ireland (¶72700); and

- many imports of services (¶67550).

Businesses which make taxable supplies above the registration limit are required to register with HM Revenue and Customs (HMRC), the government department that controls the tax (see ¶70500ff.). Registered businesses are often referred to as ‘traders’ by HMRC, and more recently as ‘customers’, although the term ‘trader’ includes businesses that would not generally be regarded as trades (e.g. a practising solicitor is normally regarded as being engaged in a profession, rather than a trade, but in VAT terms would be called a trader).

Legislation: VATA 1994 s.1

HMRC Manuals: VBNB11000ff.

Other Material: Notice 700, The VAT guide

In-Depth: ¶1-100

67010 VAT records and returns

Each registered business is obliged to keep a record of the supplies which it makes in the course of any business carried on by it, and of the VAT due on them. It must also keep a record of VAT incurred on supplies to it, and on its imports and acquisitions.

VAT registered traders must submit periodical VAT returns to HMRC. Returns are normally due quarterly, although some traders complete monthly or annual returns.

The VAT return is divided into two sections, the first section (boxes 1–5) report the following:

- total VAT due to HMRC – i.e. VAT charged on all supplies made by the trader, VAT due on goods acquired from the EU and VAT due on certain services purchased from outside the UK; and

- total amount of recoverable VAT incurred on purchases made by the trader, i.e. recoverable VAT incurred on supplies to the trader and recoverable VAT paid on overseas purchases of goods and services and import VAT.

The difference between these two amounts is payable to HMRC or, if recoverable VAT exceeds payable VAT, repaid by HMRC.

Primary legislation requires records to be kept which enable a trader to make accurate returns.

Further details of accounting requirements are given at ¶72000ff.

Legislation: Value Added Tax Regulations 1995 (SI 1995/2518), Pt. V

Other Material: Notice 700, The VAT guide; Notice 700/21, Keeping records and accounts

HMRC Manuals: VATAC1000ff.

In-Depth: ¶4-620

67020 Standard rate and other rates of VAT

The legislation does not provide a list of standard-rated supplies. Instead, it works by exception. The legislation lists zero-rated supplies (in VATA 1994, Sch. 8), reduced rate supplies (in VATA 1994, Sch. 7A) and exempt supplies (in VATA 1994, Sch. 9). Thus, any supplies not within these schedules but within the scope of VAT MUST be standard-rated (an example is goodwill).

Following the introduction of the 5p charge for plastic bags by retailers, HMRC have highlighted that such a charge is the consideration for a standard-rated supply (see HMRC Brief 14/15).

The standard rate

The standard rate is currently 20% (from 4 January 2011).

The reduced rate

In the UK, there is a reduced rate of 5% which applies to certain supplies and may be seen in VATA 1994, Sch. 7A.

Briefly, the reduced rate includes the following (there are specific conditions attached to each relief):

- fuel and power supplied for domestic or (some) charity use;

- installation of energy saving materials in residential accommodation, e.g. insulation, solar panels, central heating controls, micro combined heat and power units, etc.:

- grant funded installation of heating equipment, security goods and connection of gas supply (grants are available under various schemes for the less well off);

- women’s sanitary products (omitted from 1 January 2021);

- children’s car seats;

- construction services in connection with the following:

- renovation of dwellings which have been empty for two years or more;

- converting a property so that it contains a different number of dwellings after the conversion than it did before (e.g. converting a house into flats, non-residential building into residential use, etc.);

- converting a residential property into a different residential use, e.g. a single dwelling house into a care home or a house in multiple occupation;

- contraceptive products, including ‘morning after’ contraception (contraceptives which currently qualify for zero-rating are not affected by this provision);

- mobility aids for the elderly;

- smoking cessation products;

- static caravans;

- transport of passengers in cable suspended passenger transport systems.

It should be borne in mind that the Chancellor uses the 5% rate for socially desirable matters – it is not open to him to use the 0% rate as the member states have agreed that no more zero-rates will be applied (as referred to in ¶67000 (VAT is a European Union tax)).

The UK has been on the receiving end of EU infraction proceedings and the ECJ held that the UK had, in respect of Energy Saving Materials (ESMs), interpreted the provisions of the Principal VAT Directive too widely in VATA 1994, Sch. 7A. Following further discussions with the EC, restrictions were introduced from 1 October 2019.

Temporary reduced rate

HMRC Brief 10(2020) published 9 July 2020 contained details of a temporary reduced rate which applies to hospitality, holiday accommodation and tourism supplies. The measure was introduced as part of a package of government measures aimed at supporting the economy during the Covid-19 crisis.

The 5% rate will apply to affected supplies from 15 July 2020 to 30 September 2021 (the end of the temporary reduced rate was extended from 12 January 2021 to 1 March 2021 in the Chancellor’s statement regarding the Winter Economy Plan on 24 September 2020, and then again from 1 March 2021 to 30 September 2021 as announced in Budget 2021).

A new reduced rate of 12.5% will then apply for six months from 1 October 2021 to 31 March 2022 before standard rating will resume. (Revenue & Customs Brief 2/21)

The zero rate

The other main rate of VAT in the UK is the zero rate. Supplies which are zero-rated attract VAT at the rate of 0%.

The distinction between zero-rated supplies and exempt supplies is that, even though no VAT is charged, zero-rated supplies are ‘taxable supplies’. Therefore, businesses which make zero-rated supplies:

- can register for VAT and can recover VAT incurred on their expenses; and

- will be required to register for VAT if their turnover exceeds the VAT registration threshold. Although there is a limited exemption from registration in VATA 1994, Sch. 1 for these traders – see ¶70640.

The legislation provides a list of supplies qualifying for zero-rating and there is also a general zero-rating which applies to exports of goods from the EC and to certain deliveries of goods to other EC member states (see ¶68700ff.).

It is possible for a supply to fall within the list of exempt supplies, and also within the list of zero-rated supplies. In this case, the zero-rating takes priority, so the supply is treated as zero-rated.

Legislation: VATA 1994, s. 30(1), 31 and Sch. 1, para. 14, Sch. 7A

HMRC Manuals: VATSC02105

Other Material: Notice 708/6; HMRC Brief 14/15(August 2015)

In-Depth: ¶3-130

67030 Exemption and partial exemption

Certain supplies are exempt from VAT, so no VAT is charged on them. A business which makes only exempt supplies cannot register for VAT and so cannot recover input tax incurred on its business expenses. In contrast, a business which makes only taxable supplies can reclaim all its input tax (except that subject to a specific block, e.g. VAT suffered on certain purchases of motor cars, etc.).

Special rules are needed in the case of a business which makes both taxable supplies and exempt supplies (referred to as a partially exempt business) in order to calculate how much input tax they can recover.

In principle, a partially exempt business can reclaim in full any input tax incurred in relation to the making of taxable supplies, but cannot reclaim any input tax incurred in relation to the making of its exempt supplies. Input tax incurred on supplies which are used for making both taxable and exempt supplies is termed ‘residual input tax’. Residual input tax must be apportioned between the two activities, and only the part relating to the taxable supplies can be reclaimed.

The initial input tax deduction for significant expenditure on land and buildings (>£250,000) and on computer equipment (>£50,000) must be reviewed by reference to the use of the assets over a review period of five or ten years (see ¶68600). This is the Capital Goods Scheme.

The detailed application of these general rules, and the different ways of apportioning input tax between the types of activity, is a complex area (see ¶67860ff.).

Legislation: VATA 1994, s 26(3); SI 1995/2518, reg. 101

HMRC Manuals: PE12000

Other Material: Notice 706, Partial Exemption

In-Depth: ¶3-130

67040 Review of the system for control and enforcement of VAT

Value added tax is administered by HM Revenue & Customs (HMRC).

Businesses register for VAT by submitting an application to the VAT registration unit. Most registration applications are made online via HMRC’s website, but it is possible to submit a paper application form by post. When the application has been processed, a VAT registration number is issued, and the business is entered on the register of taxable traders.

Although it is normal to refer to ‘VAT registered businesses’, it is important to note that it is the legal entity which is registered, e.g. sole trader, partnership, limited company etc. The VAT registration will cover all business activities of that legal entity.

When registered the business will be required to submit its VAT returns either quarterly, monthly or annually according to which scheme it is using. VAT returns must be submitted online and a Government Gateway account (which can be set up via the HMRC website) will be required for this purpose. There are exemptions from the requirement to file online for those who cannot due to, for example, religious objection to electronic communication, age, disability, computer illiteracy linked to age and remoteness of location.

The trader is responsible for completing his own VAT returns correctly (see ¶72040). Failure to submit returns (or any related payments) on time can expose the trader to a penalty (see ¶72130ff.).

Periodic checks are made on traders by officers from the local VAT office or from one of the large business groups (LBGs). These officers visit the trader’s premises to inspect the VAT records to satisfy themselves that VAT is being accounted for correctly. Such visits are referred to as assurance visits (formerly, and still colloquially, control visits). The intervals between visits vary considerably, depending upon the size and type of business and the trader’s own record of compliance (or non-compliance) with the VAT accounting requirements. Very large businesses are likely to have frequent control visits, and they will have their own ‘customer relationship manager’, while smaller businesses may be visited only at intervals of several years. Visits can also be triggered by changes of pattern becoming apparent from the VAT returns submitted by the trader.

If a visit reveals that the trader has underdeclared his VAT liabilities, an assessment will normally be issued to collect the tax. The trader may also become liable to pay interest and penalties in respect of the underdeclaration. Where underdeclarations arise because of dishonesty on the part of the trader, rather than because of errors, penalties may be due either under the civil law or under criminal law. In the latter case, a dishonest trader may also be imprisoned.

Legislation: VATA 1994, Pt. IV; FA 2007, Sch. 24

HMRC Manuals: VAEC0130ff.

Other Material: Factsheet ‘CC/FS1a General information about compliance checks’

In-Depth: ¶3-500

67005 EU law and this chapter

Before 1 January 2021 UK national VAT law was required to comply with the requirements of European law, principally the Primary VAT Directive, Directive 2006/112, as a condition of the UK’s membership of the EU.

The UK left the EU on 31 January 2020 and entered a transition period during which there were ongoing negotiations concerning the future UK-EU relationship. The transition period ended on 31 December 2020.

In respect of the VAT treatment of transactions, before 1 January 2021 European law applies in the transition period as it did while the UK was a member of the EU.

In respect of the VAT treatment of transactions on and after 1 January 2021, this commentary has retained references to the relevant articles of European Law which applied before this date and their counterparts in the UK VAT legislation. Case law examples from the European Court of Justice have also been retained. The commentary proceeds on the basis that unless a section of UK VAT law has been ‘meaningfully amended’* as a result of the UK’s exit from the EU, it should, even after 1 January 2021, as a matter of statutory construction, be interpreted in the light of European law and case law.

This is for two reasons:

1When UK VAT law was enacted parliament intended that it would implement the relevant provisions of European law; and

2The European Union (Withdrawal) Act 2018 contains specific provisions to convert into domestic law:

i‘EU-derived domestic legislation’ including legislation that has been passed or made but not yet in force (EUWA 2018, s. 2);

ii‘Direct EU legislation’ which applied on and before 31 December 2020 (EUWA 2018, s. 3); and

iiiAny remaining EU rights and obligations (such as treaty rights) which do not fall within sections 2 and 3 as they had effect immediately before 31 December 2020 (EUWA 2018, s. 4).

*’meaningfully amended’ in this context means a change which goes beyond a straightforward recognition that the UK is no longer a member of the EU, i.e. the commentary assumes that, in the absence of a specific statutory provision to the contrary, there is no change to the meaning of the words used in VATA 1994 and the various associated Statutory Instruments as a result of the UK leaving the EU. Any such statutory changes will be highlighted in the commentary as and when they occur.

67100 The meaning of supply

Primarily, VAT is a tax on supplies (see ¶67750).

The UK law does not give a precise definition of the term ‘supply’ but states that it includes all forms of supply. It also states that anything done for consideration constitutes a supply.

In the majority of cases, consideration will be in the form of monetary payment, but non-monetary consideration may also be ‘paid’, e.g. in barter transactions.

Things done for no consideration are not supplies, unless there is specific provision within the law to class them as supplies. For example, the law specifies that a transfer of the property in goods, or of their possession, constitutes a supply. Thus, if goods are provided a supply arises whether or not there is consideration, i.e. if goods are given away for free a VAT charge may arise on this supply.

There is no corresponding rule for services therefore these can be provided for no consideration without a supply arising.

There are other occasions when a supply is deemed to arise, e.g. deregistration from VAT and certain self-supplies (see ¶67120 and ¶67140).

Legislation: VATA 1994, s. 5(2)(a), (b) and Sch. 4, para. 1

HMRC Manuals: VATSC02110ff.

Other Material: Notice 700, The VAT guide

In-Depth: ¶10-000

67110 Consideration for VAT purposes

The law specifically states that some transactions are to be treated as supplies for VAT purposes, whether or not there is consideration present. These are:

- the transfer or disposal of goods which are business assets so that they are no longer assets of the business. As well as gifts of business assets, this would include the transfer of the goods by a sole trader from business use to personal use. However, there is no deemed supply unless the trader was entitled to recover VAT incurred on the purchase of the goods. There is also an exemption for small value gifts (see below);

- if a trader recovers all of the input tax incurred on the purchase of fuel for motor cars (both business and non-business element), then there is a deemed supply for the private element. The value of the deemed supply is set out in fuel scale charge tables published by HMRC which state how much output tax is due. The tables are amended on 1 May each year (VATA 1994, s. 56 and 57);

- the use for non-business purposes of goods which are business assets and in respect of which input tax has previously been recovered. As well as sole traders using business assets, this includes personal use of assets by company directors and partners in a partnership, etc.; and

- when a person ceases to be registered for VAT, any goods remaining on hand are deemed to be supplied at that point unless it can be shown that either (a) VAT has not been reclaimed on their purchase, or (b) that the total VAT due on the deemed supply would be below £1,000.

It should be noted that, in applying these rules, land is specifically treated as being goods. This becomes especially important when the option for taxation has been exercised (see ¶68810).

The gift or private use of goods only gives rise to a supply if some part of the VAT on the goods concerned (or component parts) was deductible by the supplier (or some predecessor in the case of goods obtained under a transfer of a going concern).

Exceptions to deemed supply on gift of goods

(1) Small gifts

If a gift is made in the course of the business and the cost of the goods to the business does not exceed £50* the deemed supply rules do not apply and there is no need to account for output tax. If the gift forms part of a series of gifts to the same person, there is no supply unless the cumulative cost of the gifts in a 12-month period exceeds £50.

Thus, small gifts to employees or business contacts such as Christmas hampers and the like are normally relieved from tax.

This relief only applies to genuine gifts. There are many occasions where items are described as gifts but, in fact, they are provided in return for consideration in which case VAT may be due.

*Where gift goods have been obtained under a transfer of a going concern, the cost for this purpose is the cost to the transferor (or, in the case of a series of such transfers, the first transferor), not the price attributed to them under the transfer.

(2) Gifts of samples

A gift of a sample is not treated as a supply. A sample is defined by HMRC as:

‘A specimen of a product which is intended to promote the sales of that product and which allows the characteristics and qualities of that product to be assessed without resulting in final consumption, other than where final consumption is inherent in such promotional transactions.’

Legislation: VATA 1994, Sch. 4, para. 5(2), (3); Value Added Tax (Refund of Tax) Order 2006 (SI 2006/1793); VAT Directive 2006/112

HMRC Manuals: VATSC02130

Other Material: Notice 700/7, Business gifts and samples

In-Depth: ¶10-988

67120 Deemed supplies

A good rule of thumb is to regard ‘consideration’ as meaning anything (not only money) provided in exchange for something else, where the one is conditional on the other.

Business managers need to bear in mind the potentially wide meaning of ‘consideration’. Although any VAT liability of the business will normally be picked up by its accounting systems when an invoice is issued, there are cases where transactions do not enter the accounting system (because no invoice is generated) but will nonetheless give rise to a VAT liability. Managers need to be aware of ‘hidden’ consideration and should take account of it when projects are being planned.

Examples of cases where ‘hidden’ consideration may be received.

- Marketing activities which involve offers of ‘gifts’ or ‘prizes’ and which are not really free, but have to be earned in some way.

- Sponsorship agreements where one company supplies goods or services in exchange for publicity, e.g. they might donate equipment to a sports event in exchange for their logo being displayed at the venue.

The ‘anything in exchange’ concept referred to above will provide a useful way of spotting potential supplies. But it should not be relied upon to produce an infallible answer in all cases. The best plan is to use it to spot transactions which might give problems and to seek expert advice on borderline cases.

While the receipt of money will often indicate that consideration is being received for a supply made, there are occasions when money is received without being consideration for a supply. A number of these are considered at ¶67170. Examples include grants, donations and compensation payments.

It should be noted that, in practice, where something is done freely but a quid pro quo is received it may often be difficult to prove that the one is not consideration for the other.

Legal meaning of the term ‘consideration’

The term ‘consideration’ has long been used in UK law, particularly with reference to contract law. However, the UK law on VAT derives from EC law, primarily the VAT Directive 2006/112 (this is the recast sixth directive on VAT). The UK courts are obliged to construe the UK legislation so as to give effect to the directive.

Although ‘consideration’ is not defined in the VAT directive, a definition was given in Directive 67/228 (the second VAT directive) as follows:

‘The expression “consideration” means everything received in return for the supply of goods or the provision of services, including incidental expenses (packing, transport, insurance etc.) that is to say not only the cash amounts charged, but also, for example, the value of the goods received in exchange or, in the case of goods or services supplied by order of a public authority, the amount of the compensation received.’

Case law defining ‘supply’ and ‘consideration’

- Tolsma v Inspecteur der Omzetbelasting Leeuwarden, a busker was held not to be supplying services for a consideration. This was because there was no agreement between the musician and the passers-by who gave him money. To quote the judgment, there was ‘no necessary link between the musical service and the payment to which it gave rise’.

- Apple and Pear Development Council v C & E Commrs again the court determined that there must be a direct link between the supply made and the consideration received if there is to be consideration in the VAT sense. Very briefly, the Apple and Pear Development Council was set up by the UK Government in 1966 to promote the apple and pear growing industry and it was funded by a compulsory levy on farmers. The courts found that there was no direct link between the payments made by the farmers and the benefits they received because the benefits of the Council’s work accrued to the industry as a whole.

- Although consideration can be non-monetary, the courts have held that it must be capable of being expressed in money (Staatssecretaris van Financiën v Coöperatieve Aardappelenbewaarplaats GA).

- While the ‘anything in exchange’ concept referred to above gives a good rule of thumb, it cannot be regarded as a complete expression of the law. The exact meaning of consideration is not entirely clear, and continues to be a matter of debate. In one case, it was held that the act of arranging promotional parties constituted additional consideration for the supply of cosmetic cream at a reduced price (Naturally Yours Cosmetics Limited v C & E Commrs).

- The European Court of Justice has held that the payment of a grant by the EC to compensate a farmer who undertook to discontinue milk production did not amount to consideration for a supply, on the ground that VAT was intended to be a tax on consumption and, in these circumstances, there was no consumption by the EC, which was merely acting in the common interest (Mohr v Finanzamt Bad Segeberg). Similar treatment will apply to most government grants.

Legislation: VAT Directive 2006/112; Directive 67/228 (the second directive); Directive 77/388 (the sixth directive)

Cases: Staatssecretaris van Financiën v Coöperatieve Aardappelenbewaarplaats GA [1981] ECR 445; Apple and Pear Development Council v C & E Commrs (Case C-102/86) (1988) 3 BVC 274; Naturally Yours Cosmetics Ltd v C & E Commrs (1988) 3 BVC 428; Boots Co plc v C & E Commrs (1990) 5 BVC 21; Tolsma v Inspecteur der Omzetbelasting Leeuwarden (Case C-16/93) [1994] BVC 117; Mohr v Finanzamt Bad Segeberg (Case C-215/94) [1996] BVC 293

HMRC Manuals: VATSC02120

Other Material: Notice 700, The VAT guide

In-Depth: ¶10-985

67130 Supplies by a receiver

If a receiver is appointed over assets of a business, then any supplies of goods made by the receiver are treated as if they had been made by the person carrying on the business. Although VAT continues to be declared on the bankrupt trader’s VAT return, the receiver must account directly to HMRC for the VAT due.

This contrasts with the position where a receiver is appointed over the whole of a company’s assets. Here the company is regarded as having become incapacitated, and the receiver must make VAT returns and pay VAT due on behalf of the company.

Legislation: VATA 1994, Sch. 4, para. 7; Value Added Tax Regulations 1995 (SI 1995/2518), reg. 9, 27, 30

HMRC Manuals: VATSC11550ff.

Other Material: Notice 700, The VAT guide

In-Depth: ¶10-000

67140 Self-supplies

In some circumstances, a business can be treated as making supplies to itself. In these cases, the business must account for output VAT on the self-supply (via its VAT return), but can then treat it as input tax as if the supply had been obtained from another trader (the VAT is therefore recoverable on the same return). For many traders, the tax would simply appear on both sides of the VAT return and cancel out. But partially exempt businesses that can’t recover all the input tax they incur may have to make a payment to HMRC.

Self-supplies arise in certain cases specified in statutory instruments, certain cases relating to land and other instances covered below.

(1) Self-supply of motor car

VAT suffered on the purchase of a motor car cannot be recovered if the car is to be put to any non-business use (such as private mileage, including home to work travel by an employee). The rules are strict and in the majority of cases VAT incurred on the purchase of a car cannot be claimed.

However, if a business is able to recover VAT on a car purchase because it is to be used wholly for business purpose, a self-supply will occur if the car is subsequently put to non-business use.

(2) ‘Self-supply’ of residential or charitable building (a change of use charge)

A charge to VAT occurs when zero-rating under VATA 1994, Sch. 8, Grp. 5 has been obtained on the purchase or construction of a building for relevant residential or charitable use and, within ten years, the building is put to a non-qualifying use. These provisions are in VATA 1994, Sch. 10, para. 36.

(3) Self-supply of construction services

A self-supply arises if certain works of construction are carried out by a business without using outside contractors. If the value of the works is £100,000 or more, and they would have been positive-rated if bought in, a self-supply arises.

(4) Self-supply on acquisition of business by group

A self-supply arises where a business is transferred as a going concern to a VAT group of companies. This is intended to counter certain planning techniques which were previously available. The relevant provisions are in VATA 1994, s. 44.

If the group is partially exempt either during the prescribed accounting period (i.e. VAT return period) in which the supply takes place, or in the ‘longer period’ (see ¶68300ff.) which includes it, then a self-supply takes place. However, there is no self-supply if it can be shown that all of the assets transferred were acquired by the transferor more than three years before the transfer.

Legislation: VATA 1994, Sch. 10, para. 36; Value Added Tax (Self-supply of Construction Services) Order 1989 (SI 1989/472); Value Added Tax (Cars) Order 1992 (SI 1992/3122), art. 5

HMRC Manuals: VATSC02150

In-Depth: ¶12-795

67150 Reverse charge supplies

If a trader purchases services from outside the UK, it may be required to account for UK VAT on that purchase, a process known as the ‘reverse charge’ (see ¶67550).

If the reverse charge applies, the trader is treated as though they had supplied the services to themselves. The trader accounts for output VAT on the purchase (via the VAT return) and can recover this VAT as input tax on the same return. If the trader is able to recover the VAT in full there will be no payment to HMRC, but if the VAT is not fully recoverable a net payment to HMRC will arise.

The reverse charge ensures that there is no VAT advantage to purchasing services from overseas suppliers who, unlike their UK competitors, do not have to charge VAT.

Reverse charge supplies also count when considering whether the taxable turnover of the person carrying on the business exceeds the VAT registration limit (see ¶67800ff.). The purchase of services from overseas can therefore contribute to a requirement to register for VAT.

See also ¶72150 in respect of the introduction of domestic reverse charge accounting in relation to the supply of certain goods of a kind used in missing trader intra-Community fraud (MTIC).

Following on from the success of the reverse charge in combatting MTIC, a domestic reverse charge has also now been implemented, from 1 March 2021, for certain specified supplies of building and construction services (the extension of the domestic reverse charge to construction services was originally intended to take effect from 1 October 2019, it was postponed to 1 October 2020 following pressure from industry and then to 1 March 2021 due to the covid-19 crisis).

Legislation: VATA 1994, s. 7A, 8 and Sch. 4A; VATA 1994, s.55A; VAT (Section 55A) (Specified Services and Excepted Supplies) Order 2019 (SI 2019/892)

HMRC Manuals: VATREVCH10000

Other Material: HMRC Brief 36/13; HMRC Guidance – Domestic reverse VAT charge for Building and Construction Services

In-Depth: 18-245; 65-620

67160 Imports and acquisitions

From 1 January 2021 VAT also arises on:

- The import of goods into Great Britain from outside the UK;

- The import of goods into Northern Ireland from outside the UK and the EU; and

- The acquisition of goods in Northern Ireland from the EU.

Because Northern Ireland remains part of the EU single market and customs union after 1 January 2021, there is a customs border between it and the rest of the UK. VAT also arises on the movement of goods into Northern Ireland from Great Britain, in the majority of cases this VAT is accounted for because VAT is charged on the sale of goods as though it is a domestic transaction in the UK.

Until 31 December 2021, import VAT was due on the import of goods into the UK from outside the EU and intra-EU acquisitions by UK businesses.

These chargeable events are covered at ¶72400ff. and ¶72800ff.

In-Depth: ¶13-350

67170 Receipt of money which is not consideration

When something is done for consideration, there is a supply for VAT purposes (see ¶67100). It is therefore normal to conclude that, whenever a business receives money it is consideration paid for a supply made by the business. However, it is possible to receive money without that money being consideration for anything. Examples of this include:

- receipt of dividends;

- compensation payments (although care is needed to ensure that a payment is compensation, the term ‘compensation’ can be used to describe payments which are in fact consideration for goods or services supplied);

- disbursements (i.e. recovery of sums paid out on behalf of the person from whom they are claimed. The recharge of a supplier’s own expenses incurred making a supply usually represent additional consideration for that supply.);

- internal payments (i.e. payments flowing within the same legal entity);

- capital introduced into a business (corporate or non-corporate);

- loan repayments;

- gifts of money – provided that they are genuine gifts;

- grants – provided that these amount to no more than deficit funding and do not involve the body making the grant receiving any benefit;

- payments within a group of companies for group relief, provided that the payment is not expressed as encompassing anything other than the group relief (C & E Commrs v Tilling Management Services Ltd); and

- payments under a contract of indemnity (such as the payment of a claim by an insurance company).

Legislation: VATA 1994, s. 18

Case: C & E Commrs v Tilling Management Services Ltd (1978) 1 BVC 185

HMRC Manuals: VATSC06000ff.

In-Depth: ¶10-988

67180 Sale of a business as a going concern

If a business is sold as a going concern and certain conditions are met, the transaction is treated as not being a supply and VAT is not charged on the transfer (although a ‘self-supply’ charge may arise for a purchaser which is a member of a VAT group).

This non-supply treatment applies where:

- a business, or part of a business, is transferred as a going concern;

- the transfer is part of a business and that part is capable of separate operation;

- the assets transferred are to be used by the transferee in carrying on the same kind of business as that carried on by the transferor; and

- if the transferor is a taxable person, the transferee is also a taxable person (or becomes one as a result of the transfer).

If the conditions above are met, the sale of a business is a transfer of a going concern (TOGC) for VAT purposes.

Extra care is needed if the assets transferred include ‘VATed’ land or buildings (i.e. land or buildings the supply of which is standard-rated, either because the supplier has opted to tax, or because they consist of new freehold non-residential buildings). In this case, the supply of the land and buildings remains standard-rated unless the transferee opts to tax the land or buildings and notifies this to HMRC before the occurrence of the first tax point in respect of the transfer. It is also necessary that the transferee warrants that the option will not be disapplied because of the anti-avoidance provisions in VATA 1994, Sch. 10, para. 12.

HMRC Brief 27/14 addresses three specific issues when a TOGC includes an interest in land, as follows:

- HMRC’s policy on whether the surrender of a property lease can be a VAT-free TOGC;

- HMRC’s policy on whether the grant of a lease can be part of a TOGC; and

- explains a change in policy concerning TOGCs of new residential and relevant charitable developments.

TOGC treatment when a business is acquired by a member of a VAT group

HMRC’s policy has been that where a member of a VAT group acquires a business and thereafter the only supplies are made to other members of that VAT group, the acquisition cannot be treated as the transfer of a business as a going concern for the purposes of the VAT (Special Provisions) Order 1995 (SI 1995/1268), art. 5. This is because with all subsequent supplies treated as made to and by the same person, the transferor’s business ceases at the point of transfer. Consequently, the supply of the assets of the business by the transferor to the transferee is subject to VAT.

In the case of Intelligent Managed Services Ltd v R & C Commrs, IMSL had been developing a banking platform. It sold this part of its business to Virgin Money Management Services Limited (VMMSL). VMMSL continued to develop the software and then supplied software services to Virgin Money Bank Limited (VMBL). VMBL used these services to supply retail banking to its customers. VMMSL and VMBL were at the time members of the Virgin Money Group (VMG) VAT group. HMRC considered that the supply of the assets of IMSL’s business to VMMSL was subject to VAT because that business ceased at the point of transfer.

The Upper Tribunal disagreed with this conclusion, saying that the transfer of IMSL’s banking support services business to VMMSL was the transfer of a business as a going concern (TOGC).

The Upper Tribunal considered that while VAT grouping treats the representative member as carrying on the business of each member of that group, it does not change the nature of the businesses carried on by the individual members whose activities remain separate as a matter of fact. Looked at objectively, VMMSL had not intended to liquidate the transferred assets but rather to carry on the same kind of business as IMSL as part of its own banking support services. Consequently, in its judgment, there is nothing in the VAT group rules that could prevent the transfer of IMSL’s business to VMMSL from being a TOGC.

HMRC now accept that if a business is transferred to a company in a VAT group can be treated as a TOGC provided that:

- that company intends to continue to use the transferred assets to operate the same kind of business in providing services to other group members; and

- those other group members use the services to make supplies outside of the group.

Legislation: Value Added Tax (Special Provisions) Order 1995 (SI 1995/1268), art. 5

Case: Intelligent Managed Services Ltd v R & C Commrs [2015] BVC 524

HMRC Manuals: VTOGC1000

Other Material: Notice 700/9, Transfer of a business as a going concern; HMRC Brief 11/16

In-Depth: ¶54-150

67190 Supplies made outside the UK

United Kingdom VAT is charged only on supplies made within the UK. There are a series of place of supply rules which determine whether a supply is made within the UK or outside the UK. These are covered at ¶67530ff.

If a UK VAT registered trader makes a supply and the place of supply is outside the UK, the sale is outside the scope of UK VAT (and therefore no UK VAT is charged). The supply may fall within the scope of VAT charged in another jurisdiction.

Legislation: VATA1994, s.4, s.7 and s.7A

HMRC Manuals: VATPOSG2100ff.

In-Depth: 10-600

67200 Repossessed goods

Certain disposals of goods repossessed by insurance and finance companies etc. are treated as not being supplies. These rules apply if the supply of these repossessed goods by the previous owner would not have attracted VAT or would have attracted it on some amount less than the total proceeds.

The transactions affected are:

- the disposal of goods falling within a second-hand goods scheme or of a used motor car by a person who repossessed them under a finance agreement, or an insurer who acquired them as part of the settlement of an insurance claim;

- the disposal of a boat by a mortgagee who has taken possession of it under a marine mortgage; and

- the disposal of an aircraft by a mortgagee who has taken possession of it under an aircraft mortgage.

In each case, the disposals are not subject to VAT. However, relief is denied if the goods have previously been relieved of VAT, e.g. they have been exported and subsequently reimported, or they were imported into the UK free of VAT. Also, the goods must be resold in the same condition as that in which the person making the disposal acquired them.

Legislation: Value Added Tax (Cars) Order 1992 (SI 1992/3122), art. 4

HMRC Manuals: VATSC10180ff.

In-Depth: ¶18-660

67210 Gift of motor car

The gift of a motor car is treated as not being a supply if the VAT incurred on its acquisition or importation was not recoverable.

Legislation: Value Added Tax (Cars) Order 1992 (SI 1992/3122), art. 4(1)(c); Value Added Tax (Special Provisions) Order 1995 (SI 1995/1268), art. 4(1)

HMRC Manuals: VATSC03370

In-Depth: ¶13-855

67250 Whether supply is of goods or services

VAT is charged on supplies of goods and services. It is important to distinguish between goods and services because many VAT rules are different for goods and services. For example, there are differences in the rules relating to place of supply, time of supply, value of supply and VAT rate according to whether goods or services have been supplied.

There are some supplies where the VAT legislation specifies whether they are goods or services. For example, electricity is deemed to be a supply of goods.

Any supply, which is not a supply of goods and is done for a consideration, is deemed to be a supply of services.

Legislation: VATA 1994, s. 5(2)(b) and Sch. 4

HMRC Manuals: VATSC10110ff.

Other Material: Notice 700, The VAT guide

In-Depth: ¶10-455

67260 Composite (or compound) and multiple supplies

Before a supply can be classified as being of goods or of services, its real nature must be established. Often this is straightforward. For instance, if a person sells a van for a sum of money, there is clearly a supply of the van. However, if the van which is sold contains a load of carrots and these pass to the purchaser as well, there may well be two supplies: one of the van and the other of the carrots. So, sometimes what appears to be a single transaction can be made up of more than one supply and therefore how it should be treated for VAT must be established.

There are two possibilities:

- a multiple supply – where the different elements each have their own identity and each has its own VAT treatment; and

- a compound (or composite) supply – where the different elements have one VAT treatment overall and this follows the VAT treatment of the main element, so the other elements lose their VAT identity.

Example – applying the rules in practice

The sale of a calculator, with an instruction manual, might be treated as two supplies, one of the calculator (standard-rated) and the other of the manual (zero-rated). Usually, it is treated as a single supply of a calculator, the manual being seen as merely incidental to the supply.

However, consider the position if the manual went beyond the operation of that particular calculator and covered, for instance, mathematical techniques and number games. If the manual were sufficiently valuable in comparison with the calculator and was of utility in its own right, the transaction might be regarded as a multiple supply. This would be even more likely if the manual were also available separately to people who did not wish to buy a calculator.

This is an area where great care needs to be exercised. The managers of the business need to be wary of transactions which might be seen in different ways and take advice on them. HMRC are aware of the differences of treatment which can arise depending on how such supplies are viewed.

There have been many cases before the courts on this issue. A general principle is that, provided it is practical and realistic to do so, if a transaction includes a number of components some of which are liable to VAT and some of which are not, the transaction should be seen as involving a number of separate supplies and dissected accordingly.

In addition, the Court of Appeal has indicated that, while HMRC could seek to split into its components that which the contracting parties had sought to treat as a single supply, HMRC could not join together elements that the parties had themselves split in the contractual arrangements.

The seminal decision of the European Court of Justice in the Card Protection Plan case set out the principles which should be applied when considering this issue as follows.

(1)Where the transaction involves a bundle of features, regard must be had to all of the circumstances in which the supply takes place.

(2)Every supply of a service must normally be regarded as distinct and independent, but a supply which comprises a single service from an economic point of view should not be artificially split, as this would be distortive.

(3)There is a single supply if one or more elements are to be regarded as constituting the principal service, while other elements are merely ancillary and so share the same tax treatment as the principal service. A service is ancillary to the principal service if it does not constitute, for customers, an aim in itself but provides a means of better enjoying the principal service supplied.

(4)The fact that a single price is charged suggests that there is a single service, but this is not decisive. If the circumstances suggested that customers intended to purchase two or more separate services liable at different rates, then the consideration must be apportioned. The simplest method of calculation or assessment should be used for this.

There have been many cases concerned with the fundamental question of what it is that is being supplied. This is ultimately an area for subjective judgment and cannot readily be codified. It is important to consider the possible different views which might be taken of a particular transaction and, where different tax results might otherwise arise, to take all possible steps to document the true nature of the transaction (e.g. by means of formal contracts).

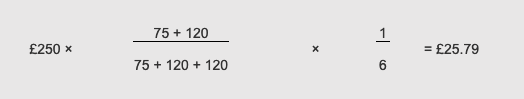

Example – valuing the component parts of a mixed supply

A business sells a package which is made up of a book, a DVD and a customer support helpline. The sale price of the package is £250. The book and the DVD can be purchased separately for £120 each. Customers can subscribe to the helpline alone for £75 p.a. They can also subscribe to the helpline and take either the book or DVD for £150 p.a.

The helpline and the DVD are standard-rated for VAT, but the supply of the book is zero-rated.

The price of £250 therefore needs to be apportioned. The VAT at 20% is found by applying the fraction 1/6 to the amount relating to the standard-rated supply.

Cases: C & E Commrs v Bushby (1978) 1 BVC 158; Bophuthatswana National Commercial Corporation Ltd v C & E Commrs [1993] BVC 194; C & E Commrs v Wellington Private Hospital Ltd [1997] BVC 251; C & E Commrs v Lloyds TSB Group Ltd [1998] BVC 173; Card Protection Plan Ltd v C & E Commrs (Case C-349/96) [1999] BVC 155; Sea Containers Services Ltd v C & E Commrs [2000] BVC 60;Levob Verzekeringen BV v Staatssecretaris van Financiën (Case C-41/04)[2007] BVC 155 ; R & C Commrs v The Honourable Society of Middle Temple [2013] BVC 1,690

HMRC Manuals: VATSC11100

Other Material: VAT Information Sheet 02/01 – Single or multiple supplies – how to decide

In-Depth: ¶10-000

67270 Supplies of goods

The VAT legislation specifies that the following are supplies of goods:

- the transfer of the whole property in goods;

- the transfer of possession of goods under an agreement for the sale of the goods, or under an agreement which expressly contemplates that the property in the goods will pass at some ascertainable future date;

- the supply of power, heat, refrigeration or ventilation;

- the granting, assignment or surrender of a ‘major interest’ in land. A ‘major interest in land’ is the freehold or a leasehold interest having a term certain greater than 21 years; and

- the transfer or disposal of goods which are business assets so that they no longer form part of the business assets, even if no consideration passes. In view of the first two items above, this last provision seems redundant in the context of distinguishing between supplies of goods and of services. It is presumably included to put it beyond doubt that a gift of goods constitutes a supply, rather than to indicate the classification of the supply.

Legislation: VATA 1994, s. 96(1) and Sch. 4, para. 1(1), 3, 4, 5

HMRC Manuals: VATSC02210

Other Material: Notice 700, The VAT guide

In-Depth: ¶10-455

Document downloaded on 15-09-2021 from Croner-i Navigate, the UK’s leading online research service for tax, audit and accounting professionals. Find out more at www.croneri.co.uk or call 0800 231 5199.

This article was correct at the date of publication. It is intended as an aid and cannot be expected to replace specific professional advice and judgment. No liability for errors or omissions will be accepted. It is the responsibility of those using the information to ensure it complies with the law at the time of use and that it is used in line with relevant rules and regulations governing the subject matter in question.

Except where otherwise indicated, all content is copyright of Croner-i Ltd.

© Croner-i Ltd, 2021

All rights reserved. No part of this publication may be reproduced without prior permission