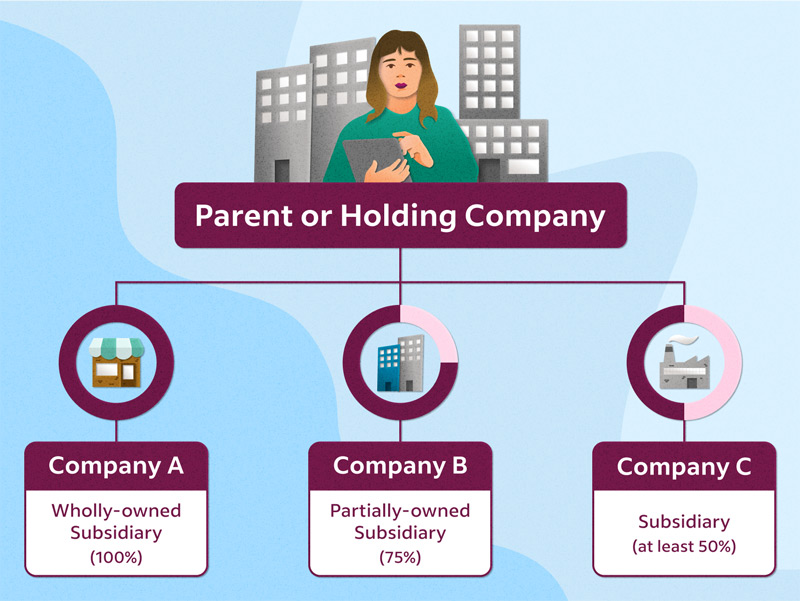

Setting up a holding company can be a strategic decision with several advantages and disadvantages. It offers a way to consolidate the ownership and control of multiple subsidiary businesses under a single entity. In this blog post, we will explore the pros and cons of establishing holding companies in the UK instead of operating multiple separate companies. Everest & Co Accountants is here to provide tailored advice and assistance to clients seeking to navigate the complexities of this business structure. For more information, feel free to contact us at 01902219680.

Pros of Setting up Holding Companies in the UK

1. Limited Liability Protection:

One of the primary advantages of creating a holding company is the limited liability protection it offers. By establishing a separate legal entity, the parent company can safeguard its assets from potential risks and liabilities associated with the subsidiary businesses. This can provide peace of mind to business owners and investors.

2. Centralized Control and Management:

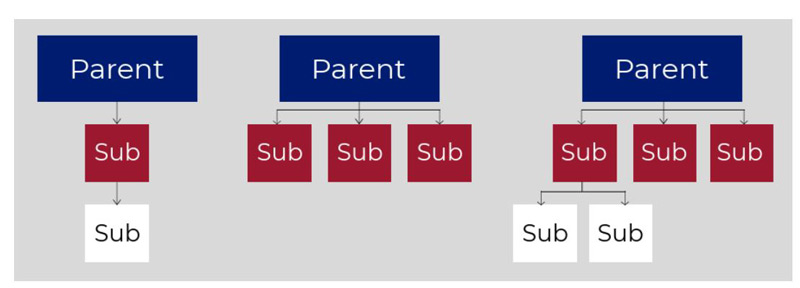

A holding company structure enables centralized control and management of subsidiary businesses. This allows for efficient decision-making, strategic planning, and better coordination between various entities. By streamlining operations, a holding company can improve overall business performance and increase profitability.

3. Tax Benefits:

Holding companies often benefit from favourable tax arrangements. The UK tax system provides a range of incentives and exemptions for organizations that qualify as holdco structures. These can include tax breaks on dividend income, reduced capital gains tax rates, and the ability to offset losses across subsidiaries.

4. Economies of Scale:

A holding company can leverage economies of scale, allowing for cost savings and increased efficiency. By consolidating administrative functions, procurement, and other shared services, the parent company can achieve cost reductions through bulk purchasing power, standardized processes, and centralized resources.

5. Flexibility in Organizational Structure:

Setting up a holding company provides flexibility in organizing the ownership structure of multiple businesses. It allows for the allocation of shares, control, and voting rights as per the specific needs and goals of the stakeholders involved. This flexibility can be advantageous when planning for succession, raising capital, or entering into joint ventures.

Cons of Setting up Holding Companies in the UK

1. Increased Complexity and Administrative Burden:

Establishing and maintaining a holding company structure can be more complex compared to operating individual companies. Additional legal, accounting, and administrative requirements may arise, including consolidated financial reporting, inter-company transactions, and compliance with intricate corporate laws and regulations.

2. Potential for Loss of Autonomy:

While a holding company provides centralized control and management, this can lead to a loss of autonomy for subsidiary businesses. Decision-making authority may be concentrated in the hands of the parent company, potentially limiting the flexibility and responsiveness of individual subsidiaries.

3. Higher Initial Costs and Capital Requirements:

The initial costs of setting up a holding company can be higher compared to operating separate entities. Incorporation expenses, legal fees, and capital requirements for each subsidiary can add up. Additionally, ongoing operational costs, such as maintaining separate bank accounts and preparing consolidated financial statements, should be considered.

4. Increased Governance and Reporting Obligations:

Holding companies are subject to specific governance and reporting obligations imposed by regulatory authorities. Compliance with company law, tax regulations, and corporate governance standards can be more demanding for a holding company structure. This requires a meticulous approach to ensure compliance and efficient administration.

Conclusion

Establishing a holding company in the UK offers several benefits, including limited liability protection, centralized control, tax advantages, and economies of scale. However, it also comes with increased complexity, administrative burdens, and potential loss of autonomy for individual subsidiaries. It is important for businesses considering this structure to carefully weigh the pros and cons and seek professional advice. Everest & Co Accountants is here to assist clients in navigating the intricacies of setting up and managing holding companies. For tailored advice and more information, please contact us at 01902219680.

Author - Mr. Anuj Paudel